Bancontact WIP

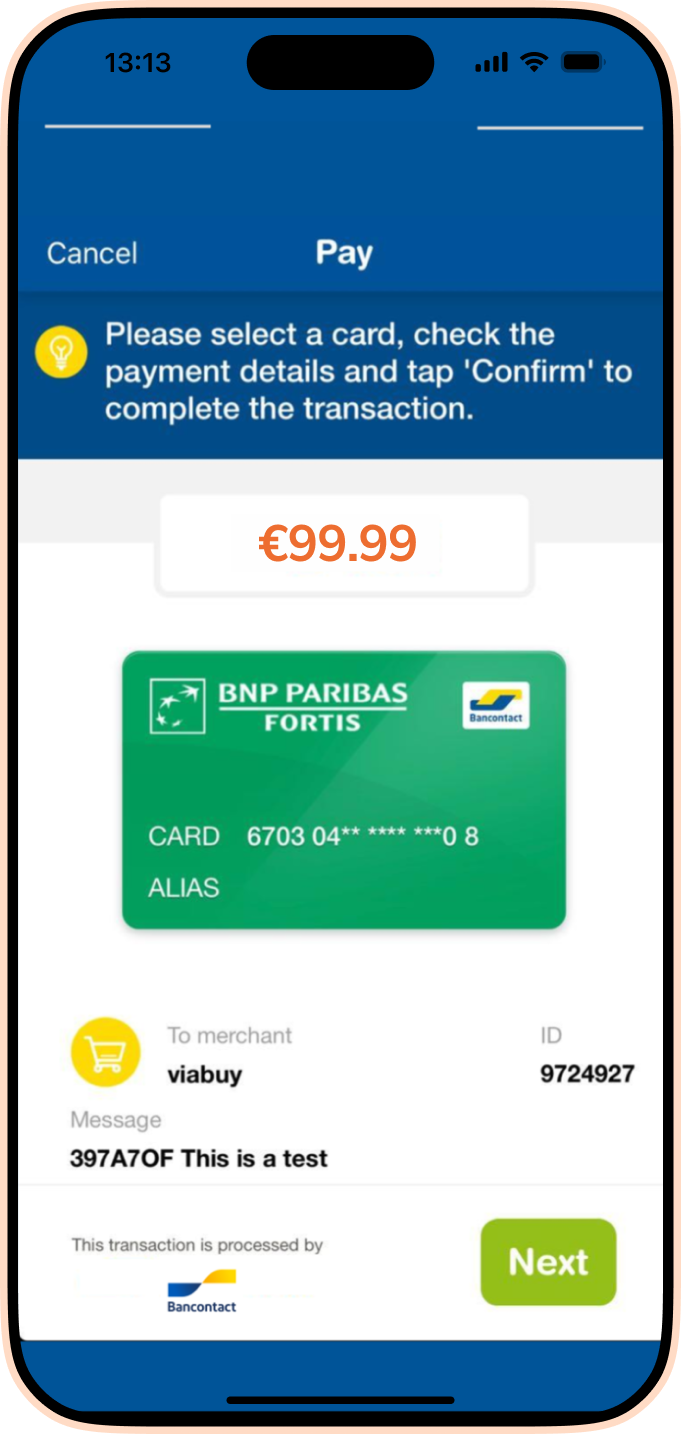

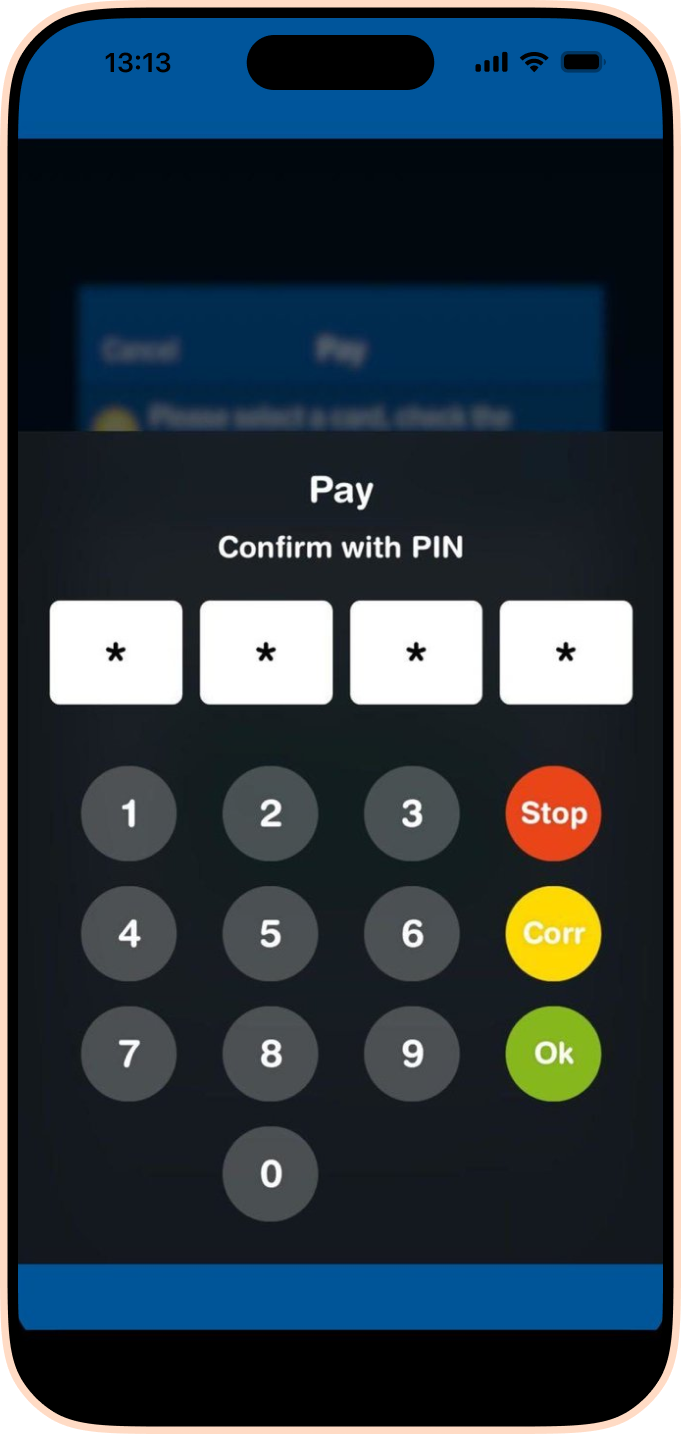

Bancontact Wallet Initiated Payments (WIP) allows recurrent transactions with Bancontact Cards, enabling one-click payments and subscription models with a seamless user experience.

Want to integrate Bancontact WIP onto your platform?

Get in touchBancontact

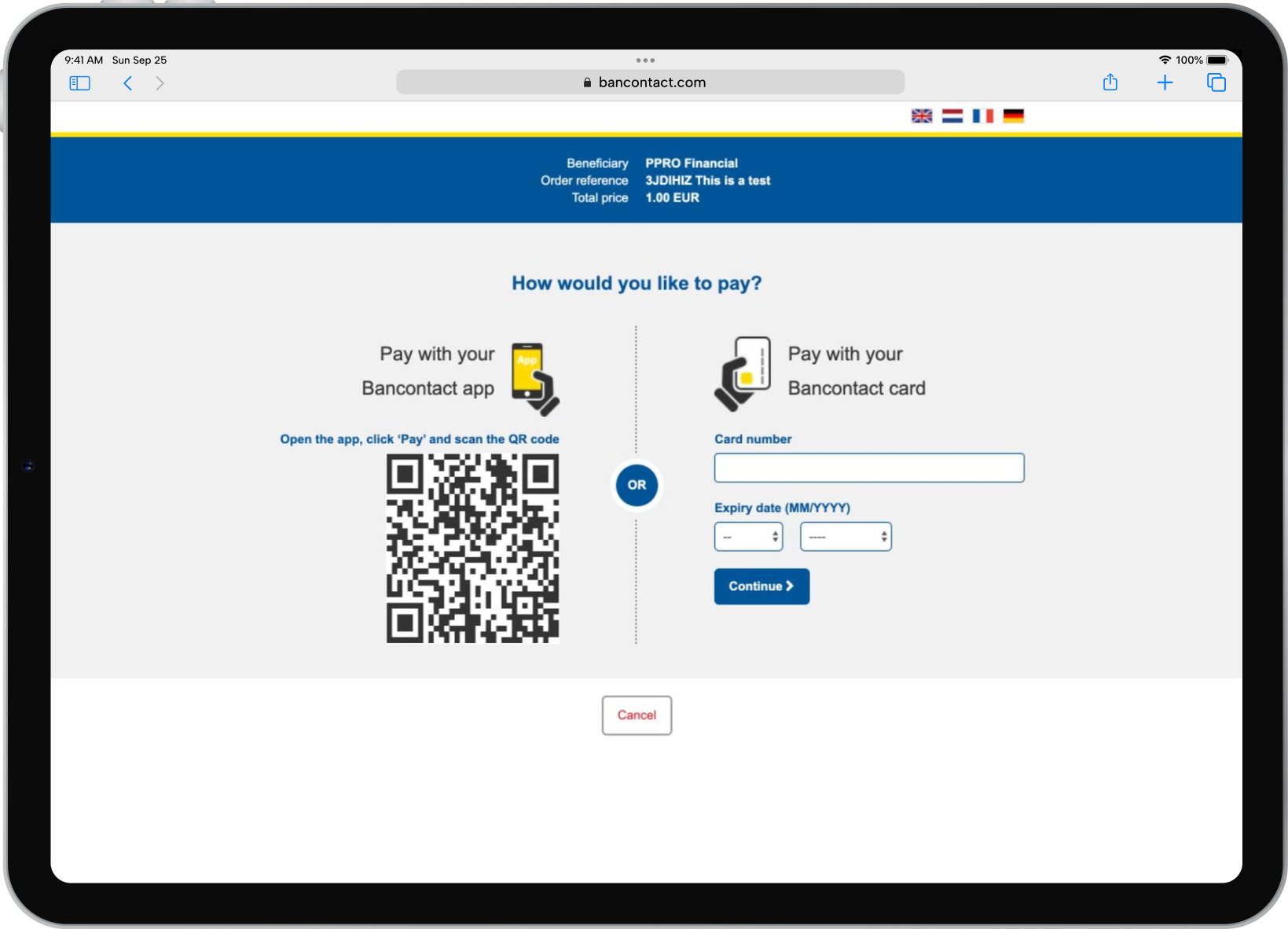

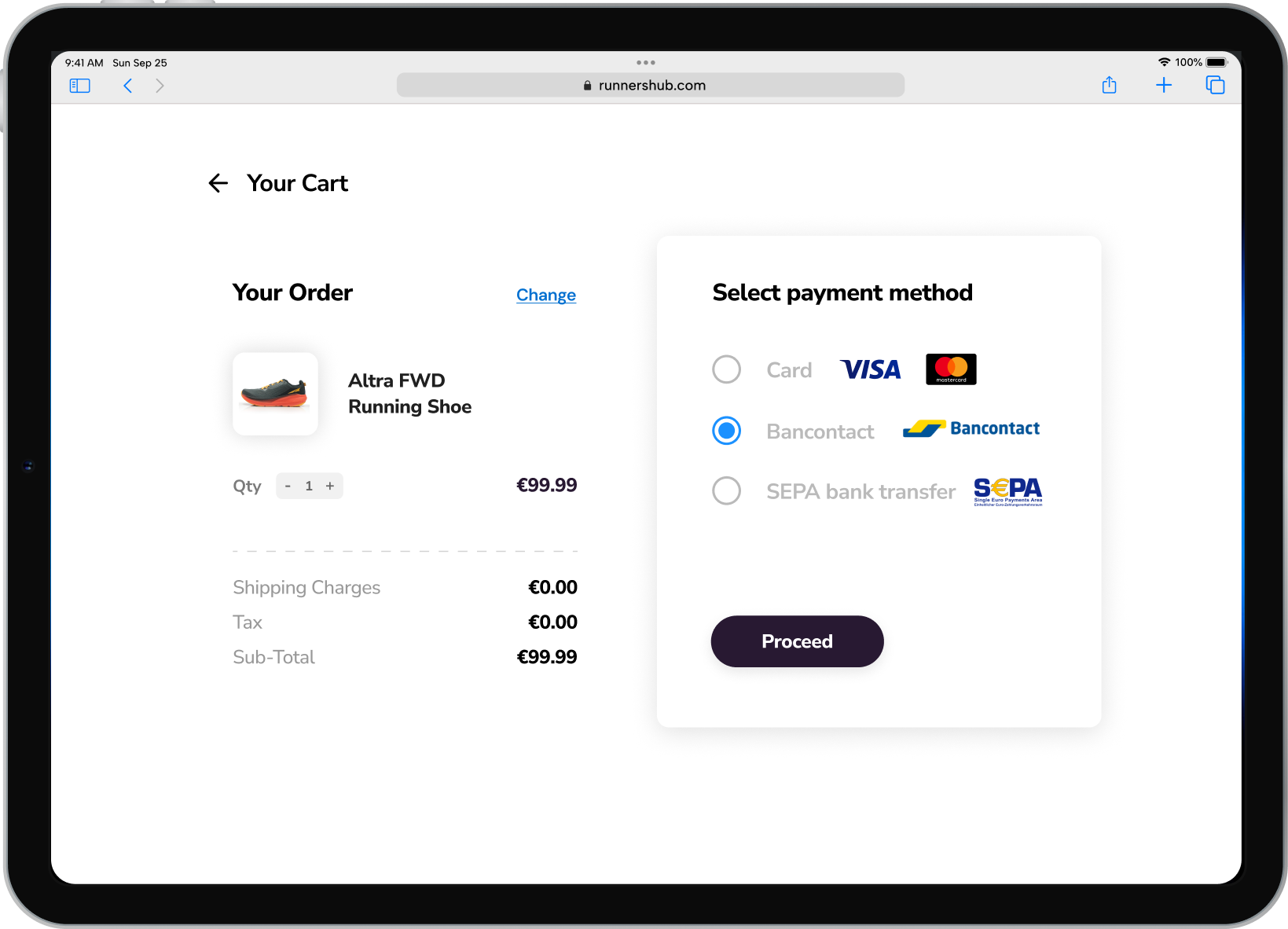

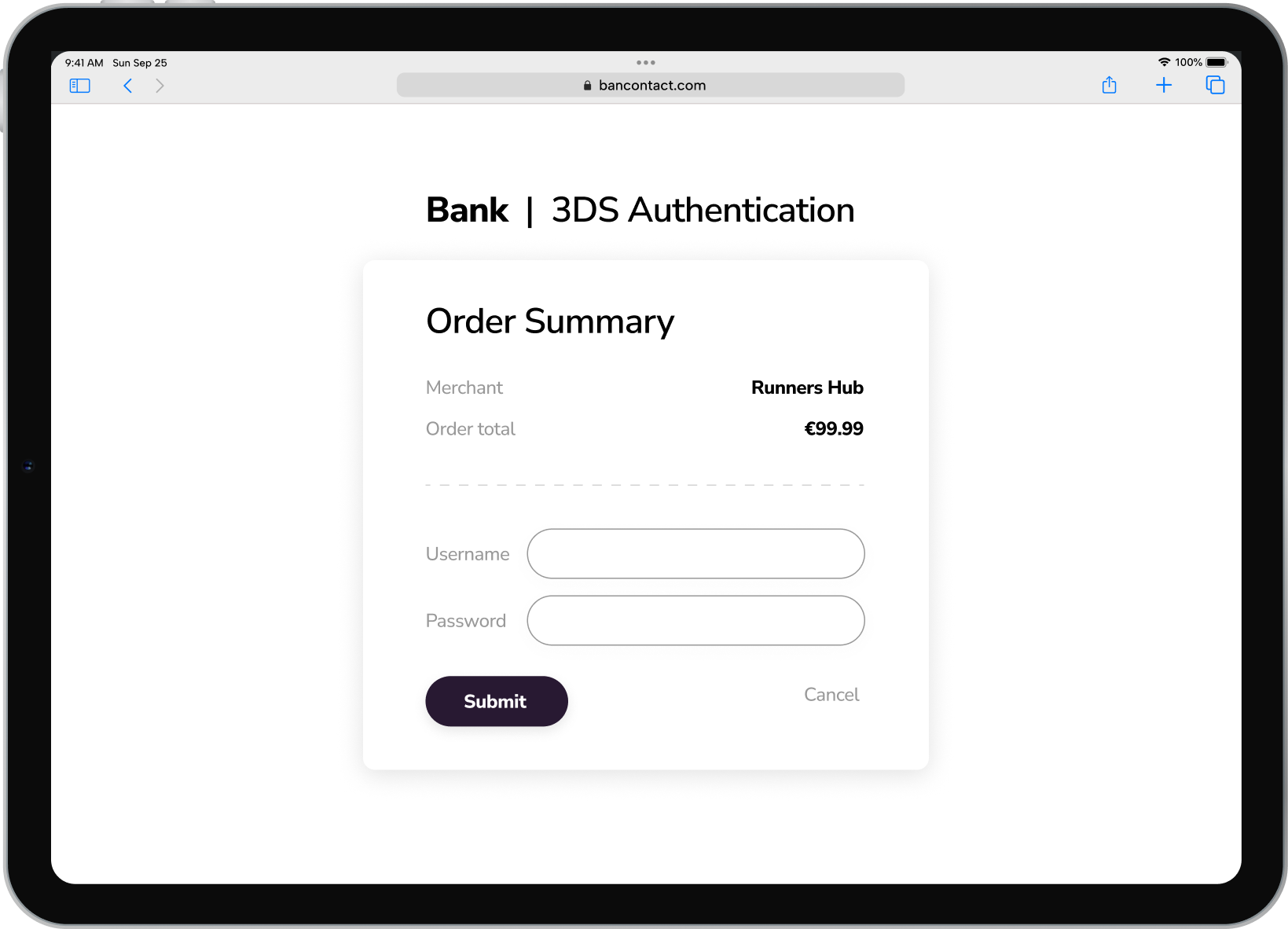

Founded in 1989, and now a brand from the Bancontact Payconiq Company, Bancontact makes it possible to pay directly through the online payment systems of all major Belgian banks for customers with Bancontact payment cards. Bancontact is the Belgian market leader in electronic payment services, with 24 banks issuing Bancontact cards including: Argenta, Attijariwafa Bank, AXA, BNP Paribas Fortis, Banque van Breda, Belfius Bank, Beobank, bpost Bank, CBC, Chaabi Bank, CPH, Crelan, Deutsche Bank, europabank, ING, KBC, Keytrade Bank, Nagelmackers and vdk Bank. At checkout, the consumer enters their card details or scans the QR code, then authorises payment.

Want to integrate Bancontact onto your platform?

Get in touchWhy Bancontact WIP

In Belgium, Bancontact accounts for over 94% of all debit cards in circulation (Cards International).

The strongest payment brand in Belgium, Bancontact surpassed other established payment brands in terms of image and familiarity (iVox).

Bancontact reported in February 2023 that over a ten-year period, payments with Bancontact and Payconiq have increased from 1 billion to 2.3 billion.

Specifications

Coverage

Currencies

Features

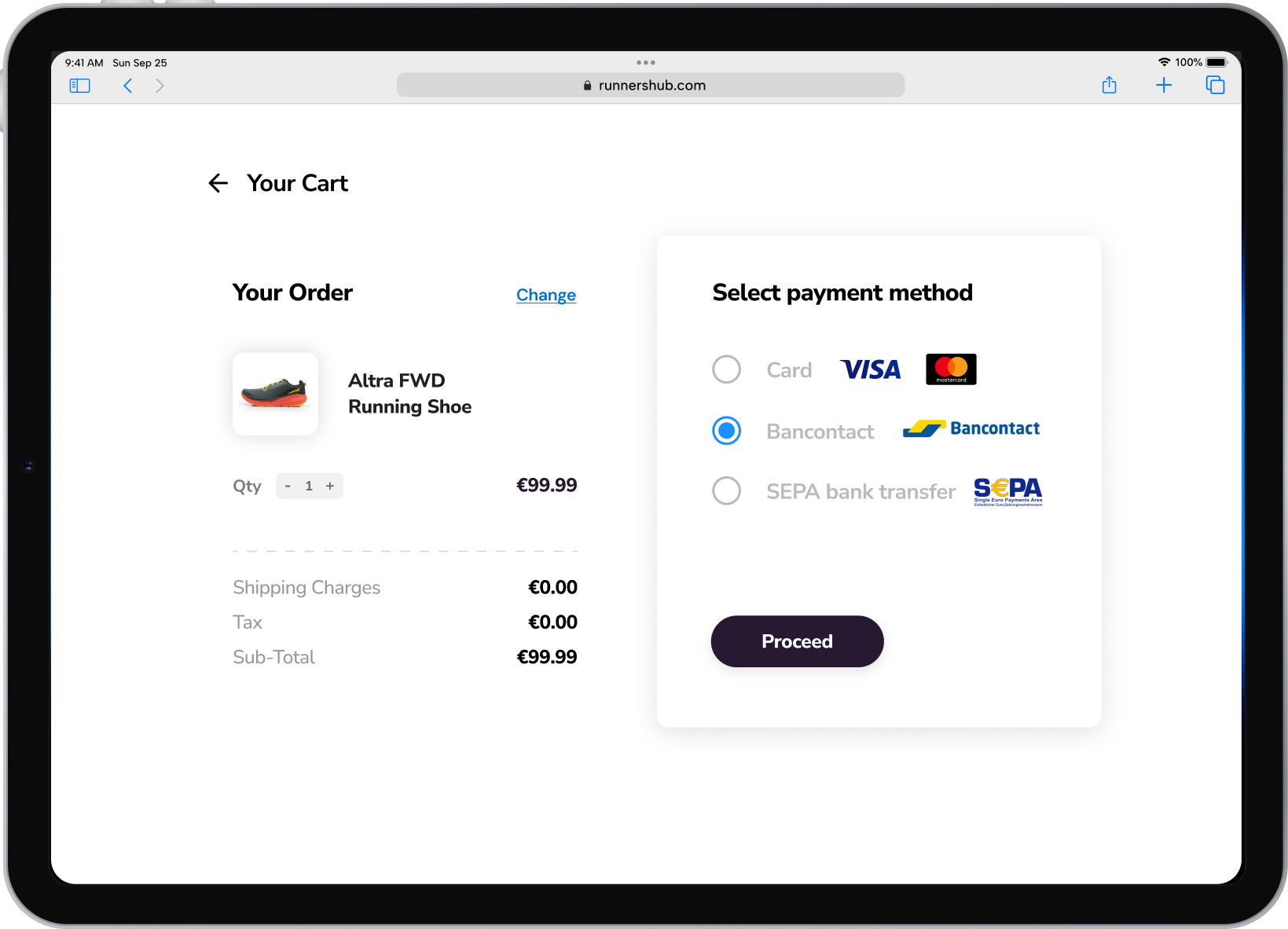

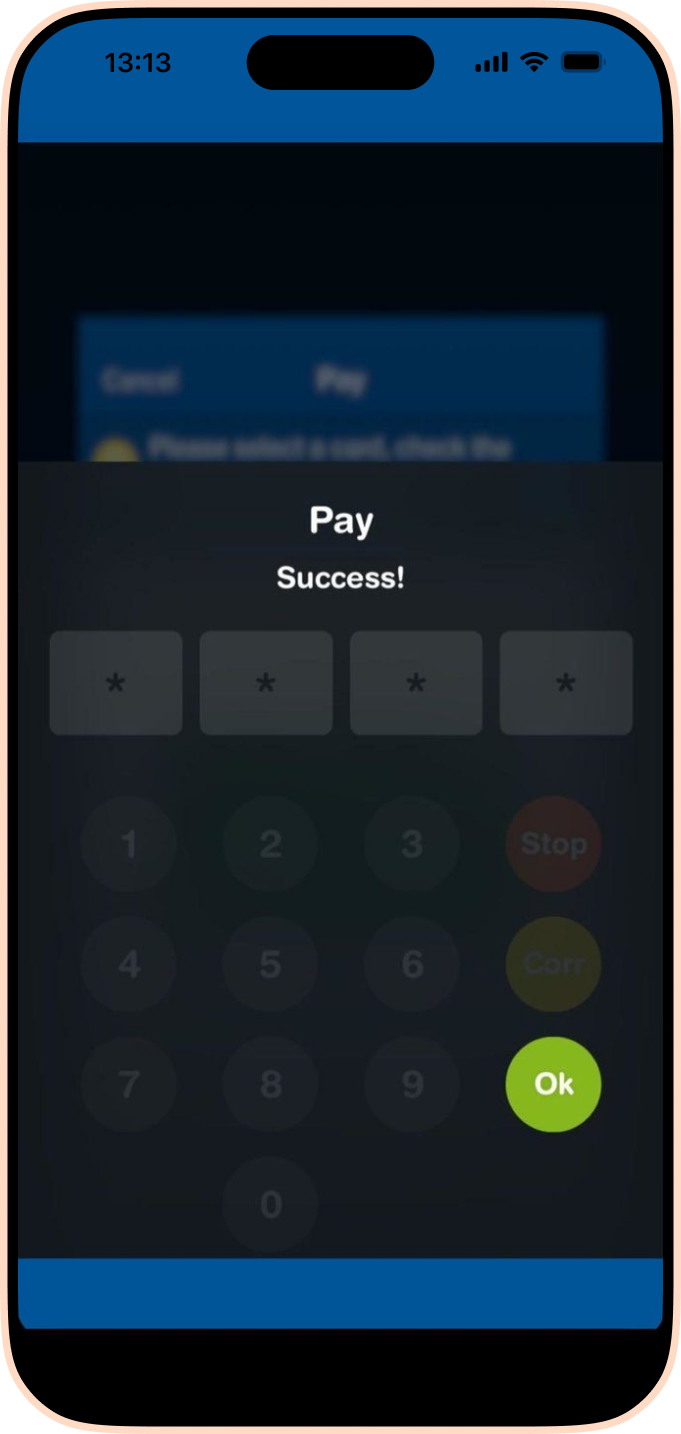

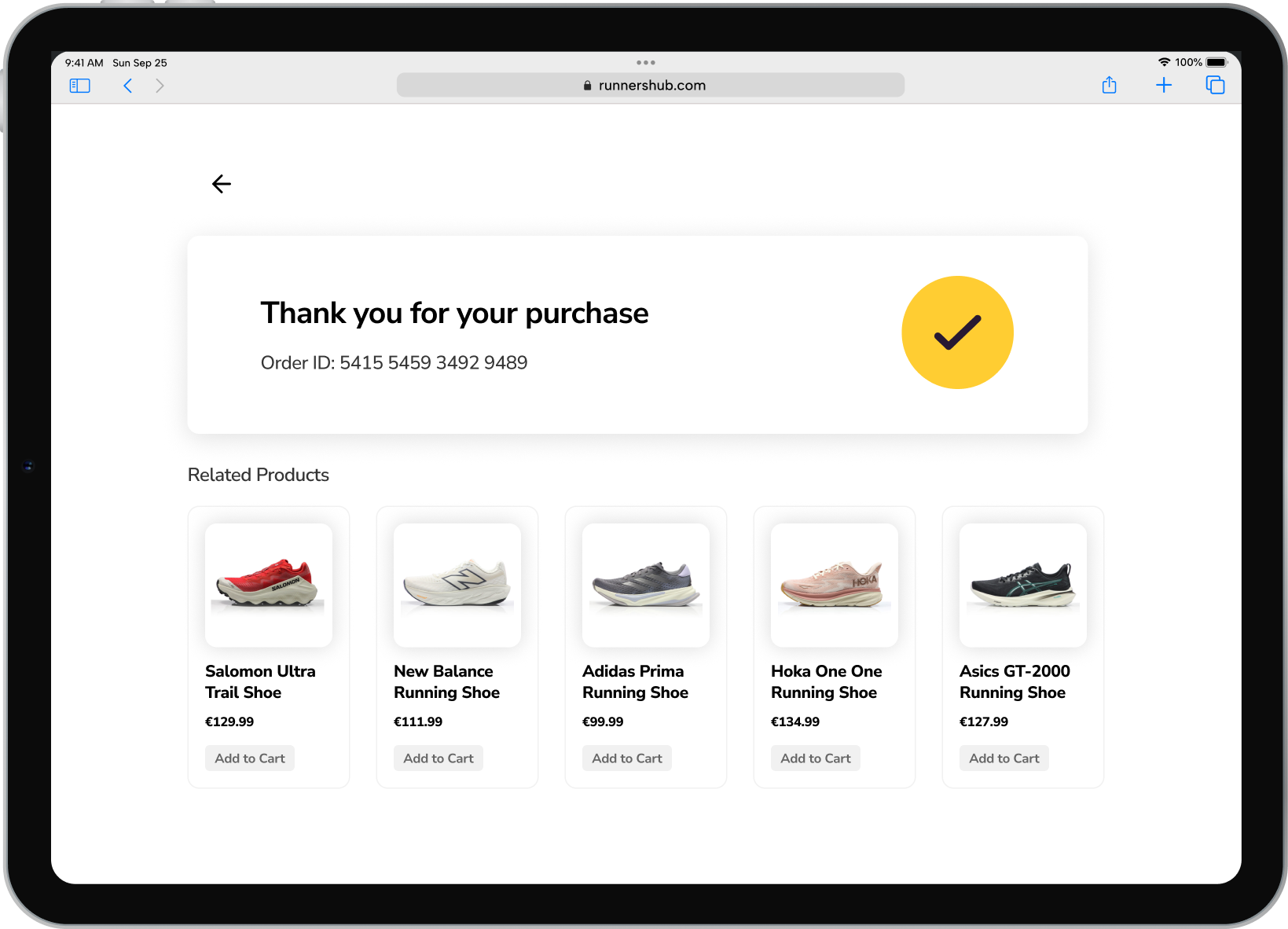

How it works

Want to integrate Bancontact WIP onto your platform?

Get in touchWhy Bancontact

In Belgium, Bancontact accounts for over 94% of all debit cards in circulation (Cards International).

The strongest payment brand in Belgium, Bancontact surpassed other established payment brands in terms of image and familiarity (iVox).

Bancontact reported in February 2023 that over a ten-year period, payments with Bancontact and Payconiq have increased from 1 billion to 2.3 billion.